The information provided on this website does not constitute investment advice or investment recommendations!

Investing brings each of us the possibility to appreciate the money we have saved. The trading of publicly traded shares of various companies listed on stock exchanges represents one of the investing options.

Stock exchanges were created for the public, to give people the opportunity to support the economy, or for companies that choose to offer part of their shares for sale as publicly traded stock. The shares are traded daily – some people buy shares; others sell shares. Also, many companies pay out a share of their profits as dividends to their shareholders – and that represents a regular passive income for them.

Let’s look at what is important in this process. It’s simple.

In line with the Snegoo® strategy, it is important to remember and maintain two basic rules when investing: “Buy low, sell high” and “Money for investment should be diversified”.

Rule no. 1 – Buy low, sell high.

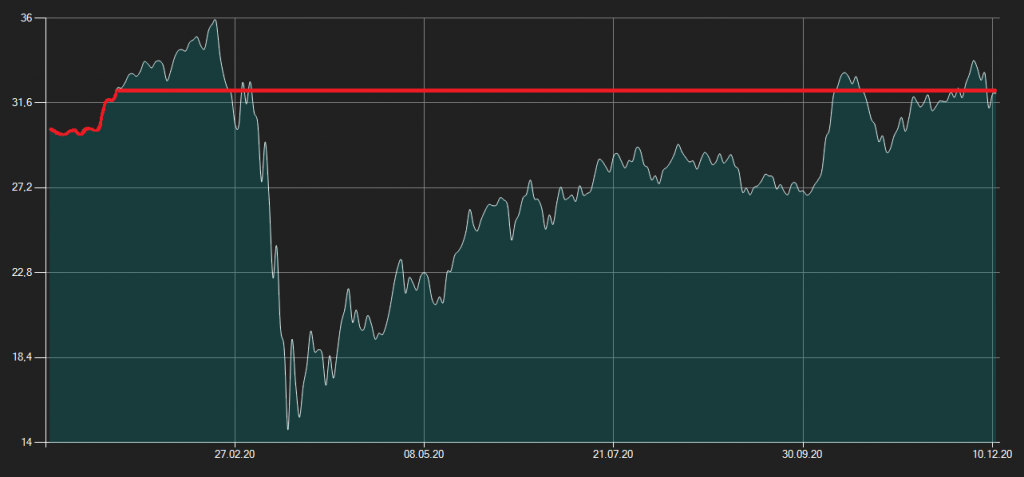

Appreciation of investments can only be achieved if the shares are sold at a price higher than the amount for which they were purchased. For better illustration, the explanation is clearly shown in the following two charts, which describe the actual historical price development of a publicly traded share of a listed company.

As shown in Chart no. 1, if the shares are purchased at a high price (at the peak), it is very likely it will take quite a long time for the share price to reach a higher value.

The probability of loss in this scenario is high!

Chart no. 1 Expensive share purchase

Chart no. 2 indicates that if the shares are bought at a reasonable price (falling), it is very likely it will be possible to sell them at a higher price in a relatively short time and thus increase their value, as expected.

The probability of profit in this case is high!

Chart no. 2 Inexpensive share purchase

Rule no. 2 – Money for investment should be diversified

50% is to be invested and 50% is to be kept as cash.

For example, if you have €10,000, it is advisable to invest €5,000 and leave the remaining €5,000 in cash. Having such amount in cash allows you to purchase cheaper shares as soon as possible, if necessary.